Untangling VAT In Batam : Navigating Value-Added Tax In The Free Trade Zone

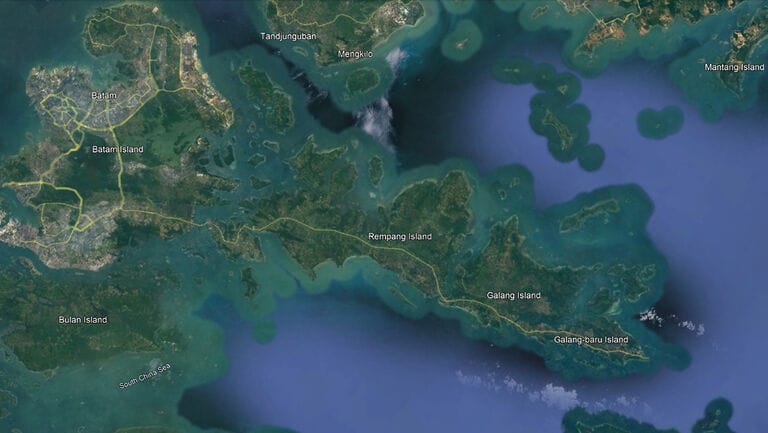

Batam, an Indonesian island conveniently close to Singapore, has a Free Trade Zone (FTZ) and Free Port, giving it a rare economic status, like VAT in Batam. Value-added tax (VAT) rules are an essential part of the economic framework of this special economic zone. Batam’s value-added tax system is designed to promote economic expansion, boost investment, and strengthen commercial exchanges. Offering exemptions and reduced VAT rates for a range of products and services is a key technique. This creates a more welcoming climate for local and foreign investors by drastically reducing the tax burden on enterprises operating within the FTZ.

The Major Logistical and Commerce Hub

Exempting or reducing VAT for certain exported goods and services is a major perk of Batam’s VAT regulations. This is consistent with Batam’s role as a major logistical and commerce hub, and it promotes businesses focused on exports. In addition, customs and import tariffs are frequently reduced or eliminated for imported raw materials and items destined for manufacture or processing within the FTZ, significantly lowering production costs for enterprises. Batam’s policies are designed to make businesses more competitive so that the city can play a larger role in the regional economy.

Unlocking Economic Potential

In addition, incentives for both domestic and international investors are provided by Batam’s VAT policy in an effort to encourage investment. VAT in Batam exemptions and reduced rates are a deliberate policy aimed at enticing a diverse range of companies, from manufacturing to technology, to set up shop on the island. Batam’s goal for the FTZ is to spur economic growth, create new job opportunities, and improve technology by providing a tax-friendly environment and promoting investments.

Business Advantage Unleashed

Batam is a vital centre for logistics and trade due to its proximity to Singapore and access to key maritime routes. Businesses are at an unrivalled advantage thanks to the favourable VAT rules and advantageous location. By taking advantage of the FTZ and the thriving Southeast Asian market, businesses may strengthen their foothold in the region and increase their profits. Batam’s value-added-tax (VAT) regulations are a major reason for the island’s thriving economy and its reputation as a place where businesses thrive.

VAT In Batam Law

Batam’s evolution as a free trade zone and free port has led to changes in the island’s VAT law in recent years. The regulations for Batam’s free trade zone and free port were published on August 20, 2007, marking the beginning of its status as a free trade zone and free port for the next 70 years. As a result, Batam’s value-added tax treatment differs from that of the rest of Indonesia. Luxury items are exempt from excise tax, VAT, and sales tax in Batam.

When certain conditions are met, imports of goods and services and the incoming or supply of taxable products and/or taxable service in a free zone are exempt from the imposition of Value Tax and/or Sales Tax on Luxury under the Ministry of Finance order (PMK-45/2009). In accordance with Article 4 of Law No. 18/2000, Value-Added Tax (VAT) is levied on:

- A taxable person’s supply of taxable goods made within Indonesia’s customs territory for the purposes of Value-Added Tax.

- Taxable items entering the country.

- A taxable person within Indonesia’s customs zone providing a service that is deemed taxable under the Value-Added-Tax.

- Making use of taxable intellectual property that has been imported into Indonesia’s customs territory.

- Use of services subject to taxation outside Indonesia’s customs zone within Indonesia’s customs zone

- In the context of value-added tax, a taxable person who exports taxable goods.

- VAT rate: 10%

The economic climate of Batam, Indonesia, can be difficult to manage without first familiarising oneself with the local Value Added Tax (VAT) rules. As a Free Trade Zone (FTZ) and Free Port, Batam has implemented VAT regulations tailored towards encouraging investment and fostering economic expansion. In line with its mission to entice domestic and international investors, Batam provides VAT exemptions and reduced rates for selected products and services. In order to encourage international trade and export-oriented industries, governments offer special tax breaks to enterprises. In addition, customs and import tariffs are generally reduced or waived for imported raw materials and items earmarked for production or processing within the FTZ, further boosting the cost-effectiveness for firms. Individuals and companies can contribute to Batam’s expanding economy and take advantage of possibilities if they have a thorough understanding of these VAT policies.

Need Help In Batam Port ? Contact Us Now!

BALANCIA SHIP AGENCY

HQ Address : Komplex Ruko Golden City Block C No.3A, Batam City, Indonesia 29432

www.balancia.co.id

Mobile Ph. : +628112929654

Office Ph. : +627784883769